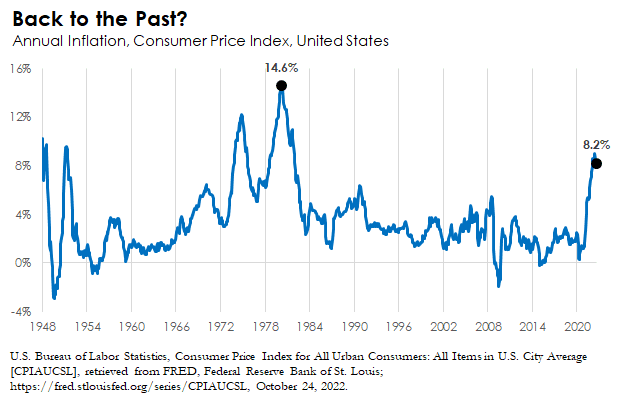

Inflation measures what happens to the overall price of a selected basket of goods and services over some time period. The Consumer Price Index (CPI) focuses on the cost of a basket of consumer goods and services for the “typical” American household. Food, shelter, energy, entertainment, health care, and many other items are tracked in this basket. In a typical month, some prices increase while others remain unchanged or constant. Inflation measures the growth in the cost of this basket of goods for households. The 8.2% current rate of inflation means that the typical household spending is 8.2% higher than 12 months ago.

Inflation comes from the consumption side (demand) or the production side (supply) of the economy (or both together). Anything that affects the productive capacity of firms affects the supply side of the economy, such as natural disasters, political unrest, pandemics, and technology changes, which affect inflation. On the demand side, events that cause more spending by households and businesses affect inflation. The demand side also is the home of government and central bank policy….more about that later.

Using this supply and demand framework, we can look at what causes inflation. When more people are trying to buy things, prices will go up. If firms have to shut down because of public health concerns or cannot get items from a distributor, production of goods and services decreases. If there are fewer goods and services available, they will be more expensive.

In the United States, the Federal Reserve (the Fed), has a dual mandate. By law, the Fed targets both low and stable prices and low unemployment. Its policy tool is called monetary policy. The Fed targets interest rates to speed up or slow down the economy. Higher interest rates discourage borrowing and spending, while lower ones have the opposite effect.[1]

Fiscal policy is when the government changes taxes and spending to influence the economy. While inflation reduction is not the purpose of fiscal policy, it has an impact on inflation. When inflation is concerning, lowering taxes or increasing spending may lead to more demand-side inflation.

Bidenflation is the name that some people have given to the current high inflation levels. They believe that the policies of the Biden Administration are causing inflation to increase. According to the Senate Republican Policy Committee, RPC, there are three key takeaways about Bidenflation. The first is that inflation is higher today than it has been in the last four decades. Second, inflation is surging, but wages are not keeping up, so purchasing power is lower. The general population is upset about the economy, and consumer sentiment is down 37%. Lastly, inflation has been caused by Democrats’ excessive spending, and reckless spending and tax hikes will send the economy into a recession.

It is factual that the inflation rate is higher today than it has been over the last four decades. This is a data point that no one can argue. How we got there is a point of debate.

The Federal Reserve has two mandates. The first is to keep prices stable, and the second is to promote low unemployment. In the early 1980s, the Chair of the Fed, Paul Volcker, believed the greatest threat to the U.S. economy was the high rate of inflation. He increased interest rate targets and the economy contracted (called a hard landing). The unemployment rate increased from around 7% to over 10%. Since that time, the Fed has maintained low rates of both inflation and unemployment without causing a lot of pain.

For more than two decades, the inflation rate has been less than 4%. Why does this matter? The E in economics should stand for expectation. One of the most visible signs of inflation is the cost of gasoline. With a current indicator sign on almost any street corner, the cost of gasoline helps shape this expectation. Inflation rates will slow again but that does not mean that the price of things at the grocery store will return to the pre-8% level.

Lastly, their third key takeaway is where they go wrong. The RPC is attributing the current inflation to the policies of the Biden Administration. The best way to fight inflation is by having a strong and growing economy. While a fiscal stimulus increases the demand side of the economy, some of the spending in the infrastructure bill can increase productivity, leading to sustained economic growth.

So, is Bidenflation a real thing? While inflation is currently higher than it has been in the past four decades, the Biden Administration’s policies are not the culprit.

So, what is causing the current high levels of inflation? It is a combination of both supply-side and demand-side shocks, most of which were beyond the control of any government or central bank. The top three: Covid-effects, war, and profit. On the supply side, it’s likely a combination of all three of these factors. The Covid-19 pandemic has increased the money supply as the government has been printing more money to stimulate the economy. The pandemic has also decreased the production of goods and services as businesses have had to shut down. And finally, there has been an increase in demand for goods and services as people try to buy things that they need. On top of that, the war in Ukraine has increased government spending and decreased the availability of some goods and services. Lastly, corporation profits are at a 70-year high with all that is happening.

Almost overnight, international commerce stopped. Factories closed. Hotels closed. Restaurants closed. The global pandemic hugely impacted the economy, with many families shifting their spending habits due to lockdowns and closures. The U.S. government sent transfer payments (stimulus checks) to households in three waves. For some, it paid the rent. For others, it went into savings to spend later. As the restrictions on businesses lifted, especially on services such as travel and restaurants, many households had a lot of money to spend, which is inflationary.

At the same time, shuttered factories reopened but the supply chains were not the same as before. What you needed to make your widget, if available, was more expensive. The ability to produce goods or provide services was reduced. Producers were first affected by shutdowns and then the inability to move products to market.

The pandemic and the re-opening were inflationary, with the demand for goods and services much higher and the ability to produce significantly changed. Boom. Inflation.

The first thing we must discuss is that the current inflationary period is not exclusive to the United States. The recent invasion of Ukraine has caused inflation to skyrocket. The price for everything from energy to wheat has risen, adding even more pressure on major economies like America’s already suffering economic woes. Since the invasion, inflation in Japan (3%), France (5.5%), the US (8.2%), Germany (10%), the UK (10.2%), and other nations have skyrocketed. Also, the war between Russia and Ukraine has caused the two economies to contract sharply.

As the war grinds on, there will be continuous shocks to the global economy. During the winter, the need for fossil fuels will greatly increase in Europe and will cause higher energy prices globally. Russia and Ukraine are also important suppliers of commodities like titanium, palladium, wheat, and corn. Due to the war, there has been an increase in these commodity prices. According to Barrons, the war has increased oil prices by 30%, a 90% increase in European gas prices, and a 17% increase in food prices. Lastly, Russia is one of the world’s largest oil producers and energy exporters. In June of 2022, Brent oil prices surged to $120 per barrel, the highest since 2014. When cruel oil changes, this represents about 40% of the change in the cost of fuel at the pump in the US. The policy of the Biden Administration to sell the US Strategic Petroleum Reserves is an attempt to increase the overall oil supply to the global market, decreasing the price of crude oil. As the price of crude decreases, there should be a percentage change felt at the pump.

Lastly, the war will have some long-lasting global economic effects. One of the items seldom discussed is the increase in federal deficits. The United States has already given $16.9 billion in military aid to Ukraine, and Congress approved an additional $40 billion in May 2022. The US government will have to issue additional Treasury bonds to finance this spending. In response, the Federal Reserve will have to keep interest rates low to minimize the cost to the US Treasury. The Federal Reserve must loosen monetary policy, increasing inflationary pressure on the economy. Also, some countries use the war as an excuse to increase defense spending. This additional spending will help support jobs in the short term but will eventually lead to inflationary pressures. Additionally, post-war, there will have to be an international Marshall Plan to help bring Ukraine back to the European community. This plan is estimated at $350 billion if the war ended today.

In the last year, many stores post signs that apologize for the lack of employees and ask for patience. Wages at restaurants, retail outlets, and other industries are increasing. However, any assumption the current economic problem is a tight labor market is incorrect. Wages have not kept up with the current inflation. This means that the price of the goods sold is increasing faster than the cost of the labor used to produce them. We need to look at profit.

The cause of this economic problem is profit-price inflation. This is where corporations raise their prices above their increasing costs. Corporations are also using the increasing costs of materials, components, and labor as an excuse to increase their process. This is the major reason we are seeing corporate profits at their highest levels in the last seven decades. In the United States where are under the false sense that, regarding grocers, there is a lot of completion. The truth is that just four companies control 85% of meat and poultry processing. There is a single corporation that set the price for most of the US seed corn. And two firms dominate consumer staples. When it comes to pharmaceuticals, there are only five. Airline? The US market went from 12 carriers in 1980 to four today. Wall Street now has five banks, broadband internet is three, and so on.

We are currently in an inflationary period and President Biden and the Democrats will be the scapegoat, right or wrong. There are a variety of factors, including supply chain issues, the war in Ukraine, and corporate greed, that have led to our current state. However, while Bidenflation is not real, his policies may have added pressure to an already inflating economy. We must be careful not to place all the blame on the Biden Administration and instead work together to solve this problem.-

What do you think needs to be done to solve the current economic crisis? Let us know in the comments below.

For more information read these:

Inflation and prices, will they return to normal? – The Chuck Kyle Show

Blaming President Biden for the Increase in Gas Prices: How Wrong is the Meme? – The Chuck Kyle Show

[1] Monetary policy in the last decade is a bit more complex, with the introduction of interest on excess reserves (IOER) as a tool to encourage or discourage liquidity in credit markets. These new tools are beyond the scope of this paper.