It’s no secret that gasoline prices specifically crude oil prices have been on the rise in recent months. And as usual, when people don’t have an answer, they tend to blame whoever is the most convenient target. In this case, many people have taken to blaming President Biden for the increase in gas prices. However, is this meme really accurate? Or are people just looking for someone to blame?

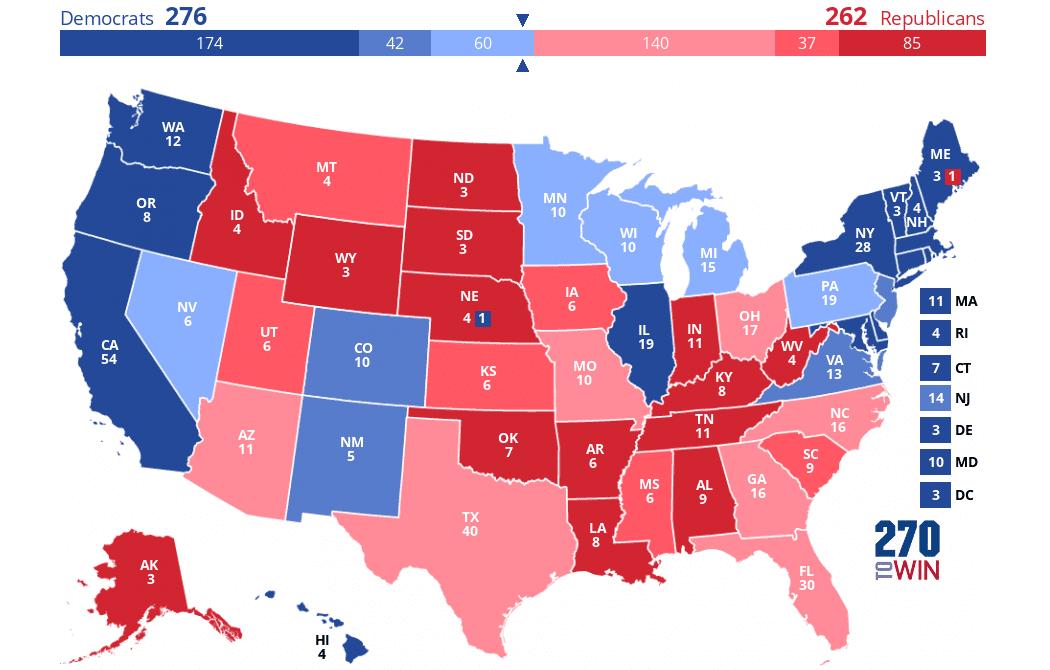

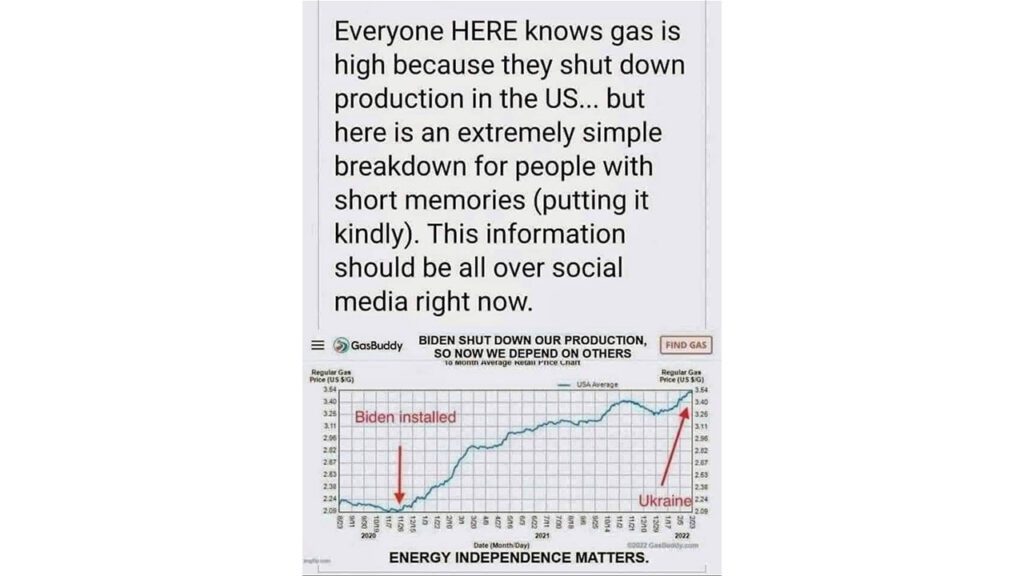

Great Chart Bad Annotations

Let’s start with the chart. The chart is from Gas Buddy and is correct. I think today they updated to the national average of $4.14. Now let’s move to the annotations. “Biden Shut Down Our Production, so now we depend on others.” There are several issues with this statement. First, production of what? Oil production? Oil refinery? Regular gasoline, which is what the chart is about, does not come straight out of the ground for use in your car. Also, where is this shut down annotated on the chart? Let’s assume oil production and the 11/26 date of “Biden Installed”.

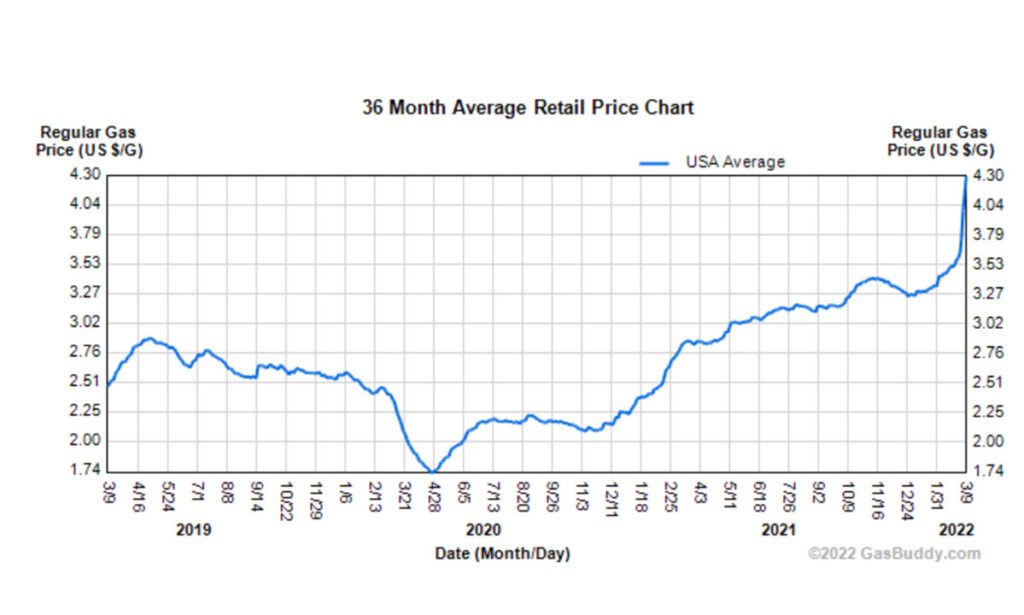

First, Biden was elected on 11/3 but did not take office until 1/20. The spike from 11/26 to 1/22, $2.09 to $2.38, what policy did Biden implement before he was in office? Is this just a bump due to speculation? However, if you go to Gas Buddy and select the chart for three years, you will see that the prices in 2019 averaged around $2.50 a gallon until February of 2020, COVID hit and the world came to a standstill, prices plummeted to their low of $1.74 on 4/27/2020. According to the Energy Information Administration (EIA), starting in April 2020, oil production began to greatly decrease from 13,000 million barrels per day (Mbpd) to 9,700 Mbpd, the lowest since September of 2017. In 2020, the US exported 8. Mbpd and imported about 7.86 million barrels per day. We both import and export oil – it is not all the same stuff.

Before the pandemic, the oil industry in the US produced 19.27 Mbpd, exporting 8.47 Mbpd. On the consumption side, the American firms, businesses, and governments used 20.54 Mbpd, of which 9.14 MMpd was imported.

A Summer of decreased demand

During the first few months of the pandemic, US production declined to 9.7 Mbpd, causing some producers to file bankruptcy.

By the summer of 2020, demand began to increase however, six US oil firms cut oil production by 300,000 barrels per day in May and June. This was due to oil prices dropping below zero in April of 2020, producers were actually paying buyers to take possession of the oil already produced. By the fall of 2020, consumption was on the rise and by 2021 was just south of 20 million bpd. The consumption expectation for 2022, is to be just at 20.66 Mbpd.

Trump was the great oil producer

During the Trump Administration, US crude oil production averaged, 10,149 Mbpd with a peak of 12,289 Mbpd in 2019. The average during the Biden Administration, for 2021, has been 11,185 Mbpd. Production-wise, the expectation is there will be a rise in 2022 and then a record-high production in 2023. This is taking into consideration all policies that the Biden Administration has on the table that would positively or negatively affect crude oil production.

Back to the chart statement that Biden shut down production thus my question, did Biden shut down oil production? It is obvious that the author’s statement is an example of disinformation. Yes, Biden passed an Executive Order against drilling on Federal lands. There have been some permits granted and others not. Yes, Biden stopped the Keystone XL pipeline project, but the data shows that Biden did not shut down US oil production.

What about the price of oil?

The price of Brent crude, an international benchmark, has risen from $40.17/barrel on election day to $129.47/barrel currently. WTI crude (US Crude) was at $38.13/barrel on election day and is now at $126.17/barrel. The increase in both is due to the overall increase in demand following the pandemic and the Russian invasion of Ukraine.

OPEC (Organization of Petroleum Exporting Countries), which includes Russia, has been cutting production since early 2020 and extended the cuts through April of 2022. The US is not a part of OPEC but is working with them to try to keep prices around $60 a barrel until Russia changed the tables.

The Biden Administration is working OPEC+ to increase their production. Will OPEC+ turn on the tap to maintain a balanced market? How will this affect the gas and oil prices?

Prices have doubled, Thanks Brandon

How could the price be double? We would have to use the April 2020 data of $1.74 to get to a number that would be half of the current national average. We’ve already discussed the pandemic, but we haven’t spoken about speculation or a worldwide conflict. First, investors are concerned. This starts in Ukraine and extends all the way to Iran, where there was no new nuclear agreement. Finally, European and American oil firms will have a smaller overall reserve as a result of the pandemic. The storage issue goes back to almost a fuel year of greatly reduced production. Oil investors are eager to pay a high premium right now for oil because they’re concerned that supply won’t be there in the following year.

We also have a structural problem with our oil markets. In the past, oil producers have always produced as much as they could and as rapidly as possible. As long as they profited, they drilled.

However, with the advent of shale oil production, we now have a lot of producers who can quickly increase or decrease production in response to price signals. So, if the price drops low enough, they will stop producing. This is what happened in 2020. When oil prices plummeted, it became too costly for the fracking companies to stay open and they folded.

From a slightly different standpoint, by mid-summer when fuel prices top $150 per barrel, or $6.50 per gallon, mainly because Russian oil isn’t flowing and President Biden has placed a ban on Russian oil, one might be able to blame him. However, is the cost at the pump a greater concern than the Ukrainian war with Russia?

What’s the Strategy?

In the US our strategy has always been to pump all the oil we have. Whereas OPEC+’s strategy is to have spare capacity. Thus why every time we run into an oil crisis, we ask OPEC+ to provide more oil. It’s not like they are turning pumps on and off, they have spare capacity and we ask them to release some, thus increasing supply, decreasing cost. You would first think that OPEC+ would be hesitant because it would cause prices to fall. However, OPEC+ countries are more concerned with prices being stable than high with a lot of vulnerability.

Prices are going up because of a population and economy recovering from a pandemic, possible worldwide conflict with a major oil-producing nation, a pending shortage of crude oil in Europe, and the investors trying to speculate on what all of this means.

Make America Independent Again (MAIA)

I do want to hit on one further point. The chart states that we should not be dependent on others. This statement goes back to the disinformation that President Trump stated on numerous occasions when he stated that we were energy independent. This was not an accurate statement. We are energy secure but since crude oil and natural gas are a global market we are not independent. Yes the US is the largest oil producer in the world and we do not need foreign oil and gas as we did before, we still import close to 8 mbpd, even during the Trump Administration.

Wrap it up

The meme that blames President Biden for the recent increase in gas prices is wrong. The truth of the matter is, there are many factors contributing to why gas prices have increased, and blaming one person on a social media platform does not answer any questions about what’s actually happening with oil production or international conflicts. For example, investors are concerned due to instability in Ukraine and the outcome of the Iranian nuclear deal, while shale oil producers in the US went out of business and stopped production because prices have dropped too low during the pandemic. Additionally, OPEC countries are more concerned with prices being stable than high, meaning they will probably side with Russia regarding Ukraine to maintain a stable oil market. Ultimately, trying to understand why gas prices have increased is much more complex than a meme on social media would have you believe, and it’s important to look at all of the factors involved before coming to any conclusions.

Do you have a question about gas prices? Ask in the comments! I’ll do my best to answer.