Inflation is a hot topic right now. Many people are wondering if prices will ever go back to where they were before the pandemic. The answer is, unfortunately, that it’s not likely. In this article, we will discuss what is inflation and how it affects the economy. We’ll also take a look at some of the reasons why prices might not go back to their pre-pandemic levels.

When prices of goods and services rise, it is known as inflation. The year-over-year rate of inflation in the United States is the percentage change in product and service prices over a one-year period. Most people think of inflation as the rise in prices of everyday items such as groceries and gasoline.

KEY TAKEAWAYS

- The rate at which the general level of prices for various products and services in an economy rises over time is known as inflation.

- When inflation occurs, money loses value because it now purchases less than it did in the past; the amount of purchasing power falls.

- The Federal Reserve has a dual mandate, maintain a low inflation rate while maintaining low unemployment

- The current annual inflation rate for the US is 7.9% for the 12 months ending in February 2022. The next inflation update will be released on April 12, 2022. The expected rate will be close to 10%. The inflation rate will likely remain high for the rest of the year, with the consumer price index for December should be around 6.5%.

- The purchasing power of one’s wages after inflation has been taken into account is known as real wage. How Do You Calculate Real Wage Change? Real Wage = W/i (W = wage, i = inflation).

What is inflation?

We are going to talk about two forms of inflation, demand-pull and cost-push. Demand-pull inflation is when there is more money chasing fewer goods. This type of inflation is often caused by an increase in consumer spending. When people have more money to spend, they are willing to pay more for goods and services. The result is that prices go up.

The second form of inflation is cost-push inflation. This happens when the costs of production go up. For example, if the price of oil goes up, the cost of transportation will also go up. This type of inflation is often caused by an increase in the cost of raw materials.

Today, the type of inflation we are experiencing is a result of demand-pull and cost-push pressures. The reason is, over the last two years, we have had a supply chain issue (cost-push), higher energy costs (cost-push), and pent-up demand from the pandemic (demand-pull) and multi-fiscal stimulus bills (demand-pull).

Why might prices not go back to their pre-pandemic levels?

There are several reasons why prices might not go back to their pre-pandemic levels. The first reason is that inflation has been rising for the past few years. This means that the purchasing power of money has been decreasing. The second reason is that the pandemic has changed people’s spending habits. Many people are now spending more money on things like food and home entertainment. This change in spending habits is likely to continue even after the pandemic ends. The third reason is that the pandemic has caused many businesses to close. This has led to a decrease in the supply of goods and services. When there is a decrease in the supply of goods and services, prices usually go up.

In conclusion, it is unlikely that prices will go back to their pre-pandemic levels. Inflation has been rising for the past few years, people’s spending habits have changed, and the pandemic has caused many businesses to close. These factors are likely to keep prices high even after the pandemic ends.

How is inflation measured?

The Consumer Price Index (CPI) is a measure of price changes in the economy for the typical household. It combines data from 23,000 firms and 80,000 consumer goods to calculate how much prices have changed in a specific amount of time. The BLS publishes it monthly (www.bls.gov). The annual rate of inflation is calculated using 12-month selections of the CPI, which is published monthly by the Bureau of Labor Statistics (BLS). The CPI went up by 3% year over year; for example, therefore the inflation rate is 3%.

But that is only half the story

Real Wage is a measure of purchasing power and is calculated by dividing nominal wage (your income before taxes and other deductions) by the price level (actual CPI). For example, if someone made $50,000 in 2019 and the CPI was 250, their real wage would be $50,000/250 = $200. In 2020, if that person’s salary stayed the same but the CPI increased to 260, their real wage would be $50,000/260 = $192.31. In other words, their purchasing power decreased because prices increased even though their salary stayed the same.

The real wage tells us how much purchasing power we have and is a better measure of living standards than the nominal wage.

If we still measured as we did in the 80s, it would be over 20%!!

The government has indeedaltered the calculation of inflation roughly 20 times in the past 30 years. The government has overhauled the Consumer Price Index, defining it as “a more accurate way to measure inflation.” According to the Bureau of Labor Statistics, this entails making several “methodological improvements.”

The government has also changed the way it weights different components in the CPI. The CPI now puts less emphasis on food and energy, which have been volatile in recent years.

In addition, the government has changed the way it measures housing costs. The CPI now uses what is called the “owner’s equivalent rent” to measure housing costs.

Did it affect CPI?

All of these changes may have had a slight effect on understating inflation. If we used the same methods to measure inflation that we used in the 1980s, the inflation rate may be a little higher but still not a 20% that has been ‘reported’ on social media.

What is the highest inflation rate in U.S. history?

Since the introduction of the CPI in 1913, the highest rate of annual inflation in the U.S. was 17.8% in 1917. The 1970s were the decade with the most years of high inflation rates. There were four years in the 1970s with inflation rates over 11%. The highest annual inflation rate during that decade was 13.34% in 1980.

What is the current inflation rate? The current annual inflation rate for the US is 7.9% for the 12 months ending in February 2022 – a new 40-year high. The next inflation update will be released on April 12, 2022. The expected rate will be close to 10%. The inflation rate will likely remain high for the rest of the year, with the consumer price index for December should be around 6.5%.

Is inflation good or bad?

The answer to this question is not as simple as it may seem. In general, inflation is bad for individuals because it reduces the purchasing power of income. Too much inflation can harm an economy, but a little bit of inflation is typically considered good.

What does this mean for you?

Like most people, you’re probably wondering how this affects you and your wallet. The short answer is: it depends. You benefit from inflation if you have a car loan or mortgage at a fixed interest rate. If you have money sitting in a savings account, you do not. And if you own a business, inflation can be either good or bad depending on how well your business is doing. In general, though, high inflation rates are bad for individuals because they reduce the purchasing power of money. Inflation is also regressive since lower-income households spend much of their income on food and energy.

Another thing to keep in mind in this era of rising prices is the Federal Reserve (Fed), our central bank. The Fed announced the intention to increase its target for something called the federal funds rate (the rate banks charge each other for overnight loans) to gradually reduce inflation and achieve what economists call a soft-landing. Expect higher interest rates, which will affect households with credit card debt or looking to borrow money.

Real wage??

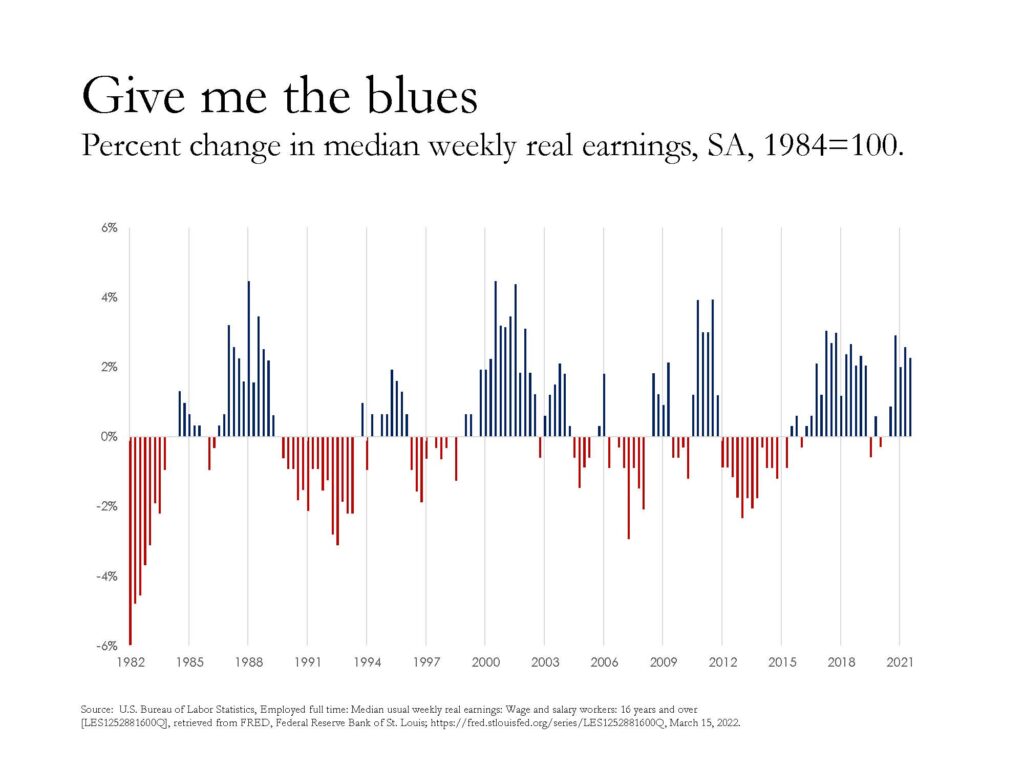

Again this is only half the story. What about real wage? In the graph above the blue bars indicate increase purchasing power, red bars, decrease in purchasing power. In the 1980s, the CPI ranged from 77 in January 1980 to 125 in December 1989. Given the real wage of the 80s compared to the real wage of 2022, The average hourly earnings of American workers have risen by more than $6 since the early 1980s, yet their purchasing power has remained largely unchanged.

Inflation and Ukraine

How will the war between Russia and Ukraine affect US inflation rates? Wall Street was expecting the inflation rate to rise to 7.6-7.7 percent before the invasion. In other words, Russia’s invasion increased the reported inflation rate by 0.2 percentage points to 7.9%, from the expected 7.7%.

In the months ahead, the Ukraine crisis will cause inflation to continue to rise. Many businesses are closing in Russia, and it’s not only those involved with the energy sector. In fact, more than 300 companies have ceased operation in Russia. Furthermore, the war has created a degree of instability in both Russia and much of eastern Europe as well as their respective supply chain component parts and raw materials supplies, such as wheat, crude oil, and various metals used in production.

Ukraine, for example, is one of the world’s largest wheat exporters. March and April are planting seasons. Expect lower wheat production, regardless of the outcome of this war. As a result of the Ukraine/Russia war, the aforementioned inflationary climate will get much worse, expecting inflation to quickly reach 10+% in the upcoming months. The biggest consumer goods that we will see affected is gasoline, which I anticipate will peak at around $6.50 a gallon, food, and clothes.

When will it end?

Although the epidemic has resulted in a reduction of goods offered by merchants, most industries will eventually recover. The issue now is that demand is growing in the face of a limited supply. If there are no more supply disruptions, I don’t see why we can’t return to seeing the same amount of product variety that we had previously. But is it possible that inflation may continue to rise? Not necessarily although recovery could take a while. Even if the supply disruptions were to be cleared right now, the impact on goods and services would linger for many months, resulting in a higher than the average inflation rate for a while.

Please return!!!

While it is possible that prices may return to pre-pandemic levels, there are four reasons why this will be unlikely. The first reason is the pandemic has caused many businesses to close which leads to a decrease in supply, placing upward pressure on prices. The second reason is that people’s spending habits have changed. People are now spending more money on things like food and home entertainment, and less money on going out to restaurants or movies. The third reason is that the inflation rate is currently quite high, and it’s expected to stay high for the rest of the year. Lastly, with the war between Ukraine and Russia, the time length of increased prices and demand is unknown. The longer the conflict continues the more normalized prices will become. All of these factors combined make it unlikely that prices will return to pre-pandemic levels in the near future.

The comparison between real wages of 2022 and the 1980s confirms the notion that the FoxNews and social media warriors segments and memes about the ‘real inflation’ just don’t play out on the data. However, the data does reveal the reality that the purchasing power of income has not increased. It also highlights the regressive nature of inflation and the income inequality that is in the United States, but that is for a different article.

What do you think? Will prices return to their pre-pandemic levels? Or, will they continue to rise?